Tesla Bets and Customer Pain

Frustrated customers are a strategy cost

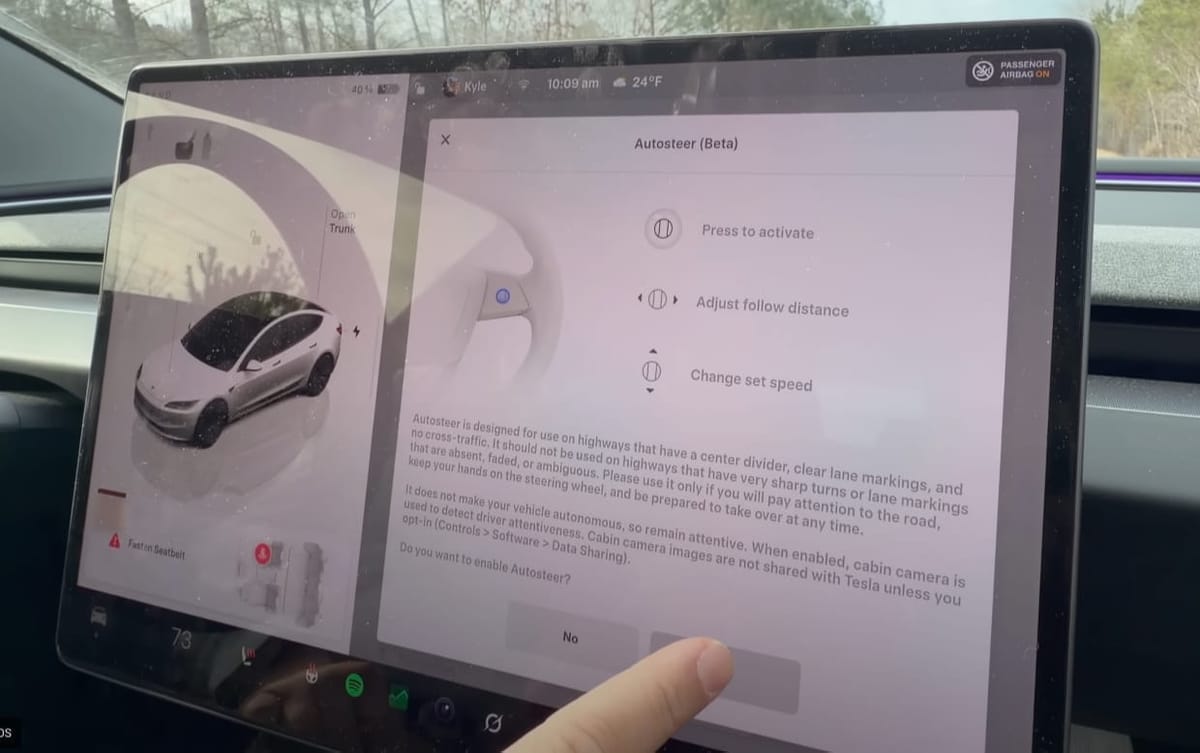

Following Tesla moving Full Self-Driving to subscription only, Reuters reports Tesla removed Autosteer from what’s included by default on new U.S. and Canadian orders. Reuters also notes Tesla stopped offering the previous Autopilot package (which included Autosteer) and stopped selling Enhanced Autopilot. Traffic-Aware Cruise Control (TACC) remains standard; Autosteer is now bundled with the $99-per-month Full Self-Driving (Supervised) subscription.

Autosteer is highway lane-centering—the feature that made Tesla’s included driver-assist feel a step above basic adaptive cruise. Without it, Tesla’s standard package becomes more like typical driver-assistance setup that manages speed and distance, but not steering.

Vocal Tesla customers and reviewers are criticizing the move.

The change landed just ahead of Tesla’s January 28 earnings report—right as investors look for evidence that autonomy can become a meaningful software revenue engine as the core EV business matures.

As is often the case with Tesla, the move is abrupt and unapologetic—one of the downsides of buying from a company that prides itself on “thinking bolder and acting faster.”

Including Autosteer in all new cars, which for many drivers is a “good enough” alternative to paying for Full Self-Driving (FSD) for everyday highway driving, risks capping FSD’s perceived value—and its take rate. By moving Autosteer into the $99-per-month FSD subscription, Tesla is prioritizing customers who want FSD—even if it costs some near-term goodwill.

More broadly, it seems Tesla is nudging FSD further toward a standalone software product, in line with its autonomy and AI ambitions. Tesla CEO Elon Musk’s pay package includes a specific 10 million FSD active subscription goal.

Musk’s pay package is a direct reflection of Tesla’s priorities. The FSD subscription goal is one of four in the plan—useful context for understanding why Tesla makes moves like this.

Musk’s Incentives

From Tesla’s 2025 Proxy Statement, the four Product Goals in Musk’s 2025 CEO Performance Award are:

- 20 million Tesla vehicles delivered

- 10 million active FSD subscriptions

- 1 million bots delivered

- 1 million robotaxis in commercial operation

The plan has a 10-year time horizon.

Taken together, these goals suggest the cars matter—but the bigger play is scaling autonomy and applying it across products like robotaxis and bots.

20 Million Tesla Vehicles Delivered

From the filing:

Expanding Tesla’s vehicle fleet from eight million EVs, which it has currently, to 20 million will further grow its Adjusted EBITDA, allowing Tesla to reinvest in its other up-and-coming product lines. Increasing the number of Tesla vehicles could also bolster Tesla’s Robotaxi network, as Tesla vehicles that are FSD-enabled may be used as ride-sharing vehicles in addition to being used as personal vehicles.

This is the straightforward one. 12 million vehicles over 10 years is impressive, but isn’t aggressive for Tesla—it sold around 1.6 million in 2025.

The primary benefit is how profits from these vehicles will allow investment in or can help enable other product lines.

10 Million Active FSD Subscriptions

Again from the filing:

FSD could create significant long-term value for Tesla’s shareholders through multiple strategic and financial avenues: first, FSD may boost the value of Tesla’s current and future vehicles by making them autonomous and creating more value for Tesla consumers; second, FSD may be offered for sale as a standalone new product offering (separate from the sale of vehicles) that could be purchased for a lump sum or licensed through a subscription, with recurring or one-time FSD sales poised to offer much higher margins than vehicle hardware; third, the technology underlying FSD will play a crucial role in Tesla’s development of Robotaxis (including by allowing Tesla drivers to deploy their Tesla vehicles into a Robotaxi fleet) and Bots (as Tesla is leveraging FSD’s core AI and vision systems to allow Bots to perceive their environment and perform tasks). Autonomy will likely improve the affordability, availability and safety of transport while reducing pollution, especially in urban communities.

That ambition is far ahead of current adoption: Tesla’s CFO said in October that about 12% of customers had paid for FSD—so 10 million active subscriptions would require a step-change in take rate, Tesla’s installed base, and/or FSD being licensed or offered beyond Tesla’s own vehicles.

Point one is the baseline: FSD increases the value of Tesla’s cars. The real strategy signals are points two and three: they frame FSD as a standalone software business—and as the underlying autonomy platform for robotaxis and bots:

- Software economics. Tesla points out that software margins are “much higher” than hardware.

- Potentially bigger than Tesla’s fleet. The filing doesn’t say that FSD must remain exclusive to Tesla vehicles. Musk has said Tesla offered FSD to other automakers, who to this point have deferred.

- A reusable autonomy stack. Tesla positions FSD’s underlying technology as foundational for robotaxis and bots—not just a feature that helps sell cars.

1 Million Bots Delivered

Bots are defined as:

[A]ny robot or other physical product with mobility using artificial intelligence manufactured by or on behalf of the Company, including Optimus, and any other successor, replacement or enhancement to such Bot.

The definition explicitly excludes vehicles.

The thinking behind the bot goal:

Bots could capture a substantial portion of the rapidly expanding market for robotics. Tesla already has the tools to position itself as a leader in the robotics space. The sale of Bots for both commercial and in-home use will create an additional product revenue stream, unlocking a market opportunity that could become a transformative product because it could redefine the concept of labor.

This is both ambitious and vague: “commercial and in-home use” is specified, but there is little detail beyond “additional product revenue stream.”

There’s a lot of leeway here; the low 10-year target arguably suggests Tesla uses hardware to learn the product and business—but expects the long-run leverage (and margins) to come from differentiated AI.

1 Million Robotaxis in Commercial Operation

Robotaxis are where the broader plan comes together:

Tesla has a competitive advantage in the autonomous driving market, compared to other participants like Waymo, as it may be able to leverage its existing fleet of eight million EVs on the road and its ongoing vertical integration efforts, both of which will allow Tesla to achieve faster and lower cost scalability than its competitors in this space. The Robotaxi offering could allow for Tesla vehicle owners to make their personal vehicles available as Robotaxis, in addition to vehicles owned by Tesla, enabling a revenue-sharing model wherein both the vehicle owner and Tesla share in generated income.

This ties back to goals one and two:

- The existing fleet of eight million vehicles helps.

- Implied: the fleet’s value for training and ongoing learning—Tesla claims FSD (Supervised) is trained on “over 100 years of anonymous real-world driving scenarios” and its fleet “collectively experiences a lifetime of driving scenarios in 10 minutes.”

- Tesla could run a revenue-sharing model where owners deploy their cars into a robotaxi fleet.

Takeaways

Musk’s pay plan has a 10-year time horizon. The numbers in each of the goals, while certainly material, serve as milestones designed to hold Musk accountable to delivery, which is important given the history of overpromising. Hitting them all won’t deliver Tesla’s endgame on its own, but collectively the goals are meant to create a foundation that supports the bet.

Tesla’s growth plan does not follow that of a typical automaker. For Tesla, the cars (and, more broadly, hardware) it sells are a means to defining and subsidizing entirely new categories, then underlying a broader ecosystem of hardware and services, and finally profiting from it all at scale through differentiated AI. Cars are a part of the journey, but not the reason for being.

While Tesla’s Autosteer change has generated a lot of criticism, any automaker could make a change like this. As the market transitions to software-defined vehicles, others will make these kinds of moves.

A major factor will be the customer experience—how it feels as the cars and their services evolve, and how well expectations are managed.

One risk of selecting a Tesla is that changes have often been on Tesla’s timeline and aligned with Tesla’s priorities, which increasingly don’t match current customer priorities the way many companies’ do. For customers and prospective buyers, the question is whether this dynamic is a feature or a dealbreaker for them.